Project Details

Geography: Pakistan

Client: Expertise France

Dates: October 2022 – October 2022

Technology: Hydropower

Project Description

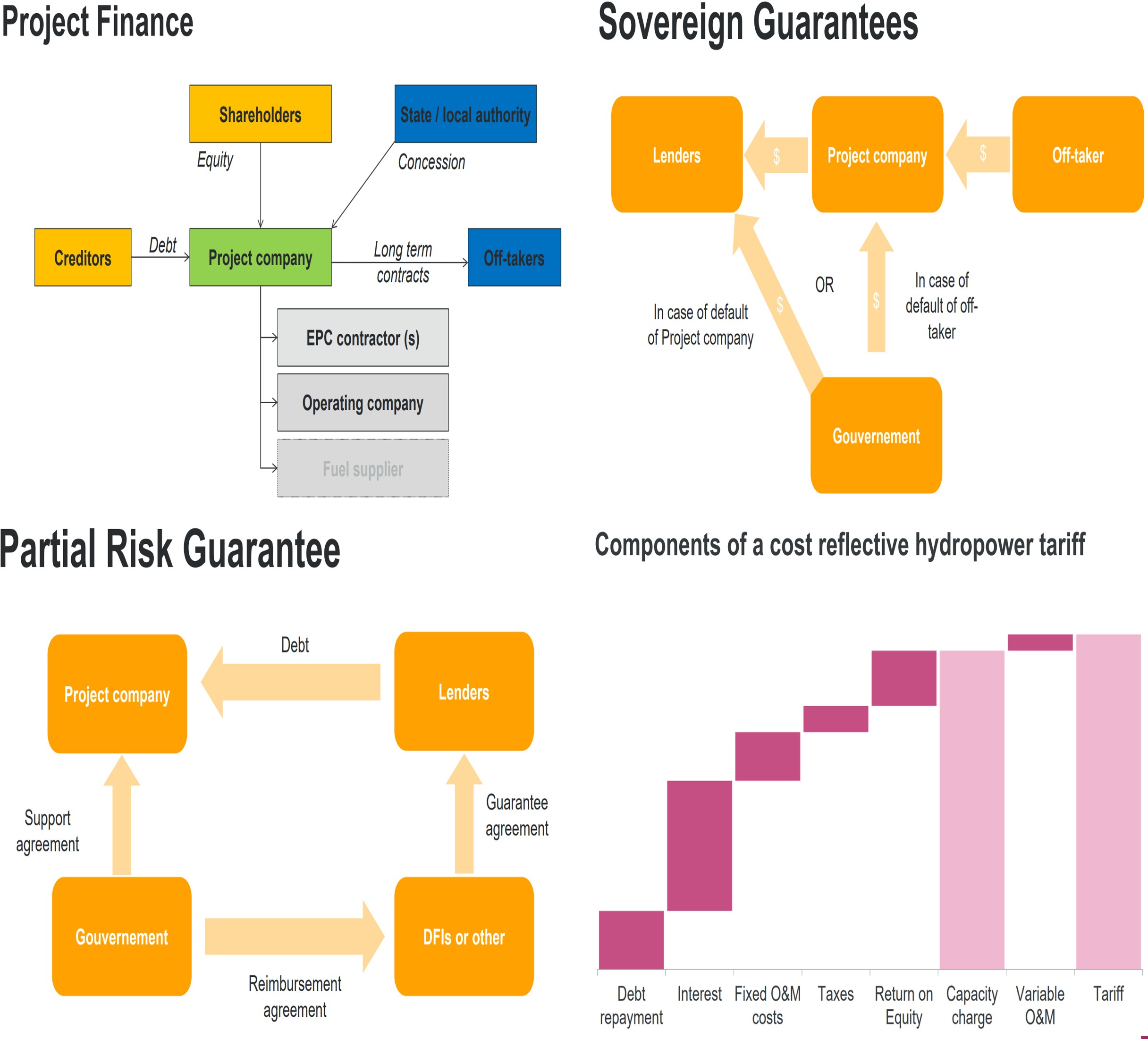

PIA conducted a capacity-building program for a delegation of Pakistan’s public authorities involved in hydropower development. The training introduced the main principles of power project financing and structuring, with a focus on hydropower-specific considerations. Sessions explored financing modes – sovereign, corporate, and project finance – along with debt and equity instruments, concessional funding, and sustainable finance mechanisms such as green bonds. The program examined key guarantee and insurance instruments, including sovereign guarantees, escrow accounts, and partial risk guarantees, as well as the role of development finance institutions. Participants reviewed tariff-setting methodologies, cost-reflective tariff components, and risk-based approaches to project structuring, illustrated through international hydropower case studies such as Bujagali, Rogun, and Souapiti. The sessions also included detailed discussions on risk management, due diligence, and contractual frameworks, emphasizing the allocation of hydrological, construction, and financial risks under public–private partnership (PPP) and IPP schemes.

Key Takeaways

The training enhanced participants’ understanding of hydropower project financing and structuring. It combined practical insights on financing sources, risk mitigation, and tariff design with real-world case studies. The sessions strengthened institutional capacity to evaluate project bankability and design resilient public–private partnership models for complex hydropower assets.

Our Building Blocks

- Capacity building

- Project financing

- Project structuring & transaction advisory

- Risk identification & assessment

- Financing large energy infrastructure projects

- Instruments and guarantees

- Public-private partnerships

- Market organisation